100% Paypal money with live proof and testimony, people

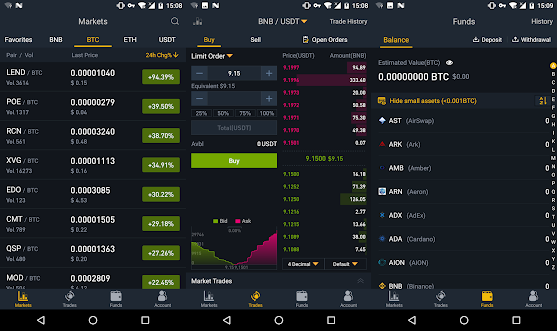

A Top Trader Made Over $700,000 On Binance Futures Last Month. Here’s How You Can Follow His Trades in Real-Time.

Market Wrap: Bitcoin Stabilizes as Altcoins Take the Lead

Market Wrap: Bitcoin Stabilizes as Altcoins Take the Lead

BTC was up 2% over the past 24 hours, while CAKE rallied 20% and ApeCoin dropped 80%.

Bitcoin (BTC) held steady around the $40,000 price level on Thursday while several alternative cryptocurrencies (altcoins) took the lead.

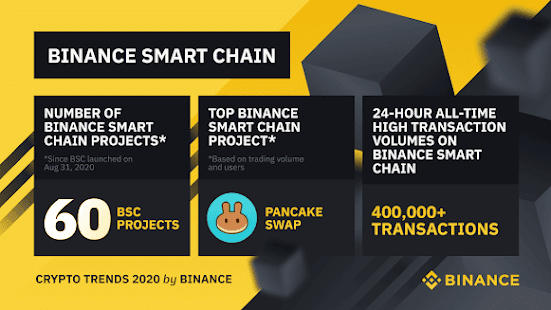

The rise in altcoins over the past few days suggests a greater appetite for risk among crypto traders. BTC and ether (ETH) were up 2% over the past 24 hours, compared with a 20% rally in PancakeSwap (CAKE). But there were some misses, especially in ApeCoin, the token linked to the popular Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collection, which dropped as much as 80% on Thursday.

Despite occasional rallies and crashes, it appears that major cryptos (large market capitalization) such as BTC and ETH are stabilizing after a volatile past few days.

Global equities are also higher, especially in Asia, after China's government pledged support for its stock market on Wednesday. Some analysts expect China's central bank to maintain low interest rates this year, which could keep the economy afloat despite the rise in COVID-19 cases and geopolitical woes.

And on the macro front, analysts expect limited upside for the U.S. dollar, which could be positive for bitcoin over the short term.

"The U.S. dollar has appreciated since Russia began its invasion of Ukraine, which is not a surprise given that the greenback has a track record of appreciating in response to geopolitical events," MRB Partners, a global investment research firm wrote in a report. "However, this strength has generally been followed by a consolidation phase."

Latest prices

●Bitcoin (BTC): $40,827, +0.15%

●Ether (ETH): $2,824, +2.96%

●S&P 500 daily close: $4,412, +1.23%

●Gold: $1,936 per troy ounce, +1.49%

●Ten-year Treasury yield daily close: 2.19%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Bitcoin's trading activity remains relatively low across major exchanges, according to CoinDesk data.

The recent peak in BTC volume was seen on Wednesday when the U.S. Federal Reserve's rate hike triggered 5% price swings. Still, trading activity has been low relative to prior volume spikes such as the price sell-off in late January and the beginning of the Russia-Ukraine war in late February.

Critical levels

Some analysts have increased their price targets for bitcoin, while others remain cautious because of ongoing macroeconomic and geopolitical risks.

"The Fed rate hike was not damning enough to worry crypto investors, hence solidifying renewed buying spirit," Alexander Mamasidikov, co-founder of mobile digital bank MinePlex, wrote in an email to CoinDesk. Mamasidikov expects selling pressure to subside toward the end of the second quarter, and has a price target at $50,000 for BTC.

Still, bitcoin will need to make a decisive break above the $40,000 psychological barrier to trigger an increase in buying activity. So far, volatility hasn’t been particularly high "taking into account a barrage of largely negative news over the past few days with COVID-19 cases rising and China’s Shenzhen province going into lockdown," Mikkel Mørch, executive director of ARK36, a crypto investment fund, wrote in an email.

Generally, the narrative of bitcoin as a safe haven and store of value has been consistent across some analyst commentary despite the recent decline in a risk-off environment, similar to what occurred in 2018 and 2020.

Despite short-term stabilization, bitcoin's market capitalization relative to the total crypto market cap remains elevated this year. Typically, BTC outperforms (declines less) in a down market because of its lower risk profile relative to altcoins.

Altcoin roundup

- HSBC enters the Metaverse through partnership with The Sandbox: HSBC (HSBC), with almost $3 trillion in assets, is the first global bank to enter The Sandbox metaverse. The bank will buy a plot of land at The Sandbox metaverse, which it will develop to engage with sports, e-sports and gaming fans, the statement said. Details of HSBC's development in the virtual plot of land weren't announced. A promotional GIF that was posted along with the statement showed an HSBC stadium next to a virtual body of water, according to CoinDesk’s Eliza Gkritsi. Read more here.

- APE token tied to Bored Ape Yacht Club NFTs sinks 80%: ApeCoin, the token linked to the popular Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collection was airdropped to Bored Ape NFT owners on Thursday after being announced Wednesday as a part of a larger ApeDAO campaign, but holders quickly selling the coin have sent its price plummeting. The token has fallen from its highest price of $39.40 to a now stable $8.90, trading for as low as $6.48, per CoinMarketCap, according to CoinDesk’s Eli Tan. Read more here.

- Andrew Yang launches new DAO for AAPI advancement: Former U.S. presidential candidate Andrew Yang has launched GoldenDAO, a decentralized autonomous organization (DAO) dedicated to Asian American and Pacific Islander (AAPI) issues. The effort comes right after Yang’s first foray into DAOs. Last month, he announced Lobby3, a new organization advocating for Web 3 policies in Washington, D.C. In recent months, DAOs have been used for everything from social clubs to investment syndicates to crowdfunding vehicles, according to CoinDesk’s Tracy Wang. Read more here.

Bitcoin Mining Difficulty: Everything You Need to Know

Bitcoin Mining Difficulty: Everything You Need to Know

Bitcoin Mining Difficulty: Everything You Need to Know

In order to ensure bitcoin blocks are discovered roughly every 10 minutes, an automatic system is in place that adjusts the difficulty depending on how many miners are competing to discover blocks at any given time.

Because the Bitcoin network is completely decentralized and not run by any single overarching authority, an algorithm hard-coded into the source code by Bitcoin’s creator(s) Satoshi Nakamoto is used. This algorithm constantly readjusts the difficulty of the mining process in line with how many miners are operating in the network to ensure that blocks are discovered at a steady pace.

In this guide, we will explore this concept extensively, highlight its importance and detail the method used to determine and adjust bitcoin mining difficulty.

Because the Bitcoin network is completely decentralized and not run by any single overarching authority, an algorithm hard-coded into the source code by Bitcoin’s creator(s) Satoshi Nakamoto is used. This algorithm constantly readjusts the difficulty of the mining process in line with how many miners are operating in the network to ensure that blocks are discovered at a steady pace.

In this guide, we will explore this concept extensively, highlight its importance and detail the method used to determine and adjust bitcoin mining difficulty.

A primer on bitcoin mining

The bitcoin mining process is central to the security and validity of the entire network and its native cryptocurrency – bitcoin (BTC). Mining lies at the core of Bitcoin’s consensus system – that is, the system of agreement used by bitcoin to ensure all distributed participants reach consensus on new data entering the blockchain. The network relies entirely on a decentralized transaction validation process whereby anyone in the world can take up the responsibility of validating new transactions and adding them chronologically into the blockchain via new blocks.

As simple as this sounds, the whole process – known as proof-of-work – involves a computer-intensive effort that requires the would-be validators to use their machines to generate a winning fixed-length code before anyone else does.

Read more: How Bitcoin Mining Works

By forcing validators to expend some form of energy to discover new blocks, the idea is it dissuades potential bad actors from participating in the network and attempting to corrupt the blockchain with invalid transactions.

To increase their odds of winning, miners over the years have switched over to using specialized computing equipment called application-specific integrated circuit (ASIC) miners that are capable of generating over one quintillion random codes a second; an exponentially higher number of guesses than any regular laptop is capable of producing per second.

The bitcoin mining process is central to the security and validity of the entire network and its native cryptocurrency – bitcoin (BTC). Mining lies at the core of Bitcoin’s consensus system – that is, the system of agreement used by bitcoin to ensure all distributed participants reach consensus on new data entering the blockchain. The network relies entirely on a decentralized transaction validation process whereby anyone in the world can take up the responsibility of validating new transactions and adding them chronologically into the blockchain via new blocks.

As simple as this sounds, the whole process – known as proof-of-work – involves a computer-intensive effort that requires the would-be validators to use their machines to generate a winning fixed-length code before anyone else does.

Read more: How Bitcoin Mining Works

By forcing validators to expend some form of energy to discover new blocks, the idea is it dissuades potential bad actors from participating in the network and attempting to corrupt the blockchain with invalid transactions.

To increase their odds of winning, miners over the years have switched over to using specialized computing equipment called application-specific integrated circuit (ASIC) miners that are capable of generating over one quintillion random codes a second; an exponentially higher number of guesses than any regular laptop is capable of producing per second.

Why bitcoin mining difficulty matters

The Bitcoin difficulty algorithm is programmed to keep the entire system stable by maintaining a 10-minute duration for finding new blocks. In essence, it takes roughly 10 minutes for one miner out of the entire network to generate a winning code and win the right to propose a new block of bitcoin transactions to be added to the blockchain.

To maintain this frequency, the algorithm steps in and increases or decreases the difficulty of mining bitcoin. Whenever there’s an influx of miners or mining rigs, it ramps up the difficulty of mining bitcoin. If the reverse is the case (that is, if there is a drop in the number of miners competing to find new blocks), the protocol reduces the mining difficulty to make it easier for the remaining miners to discover blocs. The mining difficulty of the bitcoin network is altered by adding or reducing the zeros at the front of the target hash.

The target hash is the name given to the specific hash (fixed-length code) that all miners are trying to beat. Whoever generates a random code that happens to have an equal or higher number of zeros at the front than the target hash first is selected as the winner.

Read more: What Does Hashrate Mean?

Without such a system in place, blocks would likely be discovered faster and faster as more miners joined the network with increasingly sophisticated equipment. This would result in new bitcoin entering circulation at an unpredictable rate and would likely have the knock-on effect of inhibiting it’s rise in value.

It’s important to note, a huge part of bitcoin’s appeal is its steady, predictable rate of inflation compared to the unpredictable and rampant inflation of fiat currencies caused by excessive quantitative easing. The fact that the circulating supply is capped at a maximum of 21 million coins also means it’s a truly finite asset with a relatively scarce maximum supply. Both of these factors should, in theory, help support bitcoin’s price over time – assuming demand remains high.

The Bitcoin difficulty algorithm is programmed to keep the entire system stable by maintaining a 10-minute duration for finding new blocks. In essence, it takes roughly 10 minutes for one miner out of the entire network to generate a winning code and win the right to propose a new block of bitcoin transactions to be added to the blockchain.

To maintain this frequency, the algorithm steps in and increases or decreases the difficulty of mining bitcoin. Whenever there’s an influx of miners or mining rigs, it ramps up the difficulty of mining bitcoin. If the reverse is the case (that is, if there is a drop in the number of miners competing to find new blocks), the protocol reduces the mining difficulty to make it easier for the remaining miners to discover blocs. The mining difficulty of the bitcoin network is altered by adding or reducing the zeros at the front of the target hash.

The target hash is the name given to the specific hash (fixed-length code) that all miners are trying to beat. Whoever generates a random code that happens to have an equal or higher number of zeros at the front than the target hash first is selected as the winner.

Read more: What Does Hashrate Mean?

Without such a system in place, blocks would likely be discovered faster and faster as more miners joined the network with increasingly sophisticated equipment. This would result in new bitcoin entering circulation at an unpredictable rate and would likely have the knock-on effect of inhibiting it’s rise in value.

It’s important to note, a huge part of bitcoin’s appeal is its steady, predictable rate of inflation compared to the unpredictable and rampant inflation of fiat currencies caused by excessive quantitative easing. The fact that the circulating supply is capped at a maximum of 21 million coins also means it’s a truly finite asset with a relatively scarce maximum supply. Both of these factors should, in theory, help support bitcoin’s price over time – assuming demand remains high.

How frequent is bitcoin mining difficulty adjusted?

Bitcoin’s mining difficulty is updated every 2,016 blocks (or roughly every two weeks). This is why each 2,016 block interval is called the difficulty epoch, as the network determines whether the activities of miners for the last two weeks have reduced or increased the time it takes to mine a new block. If the time it takes is below 10 minutes, the mining difficulty will be increased. The opposite occurs when the block time is above 10 minutes.

Bitcoin’s mining difficulty is updated every 2,016 blocks (or roughly every two weeks). This is why each 2,016 block interval is called the difficulty epoch, as the network determines whether the activities of miners for the last two weeks have reduced or increased the time it takes to mine a new block. If the time it takes is below 10 minutes, the mining difficulty will be increased. The opposite occurs when the block time is above 10 minutes.

How is bitcoin mining difficulty calculated?

Bitcoin mining difficulty is calculated with various formulas. However, the most common one is: Difficulty Level = Difficulty Target/Current Target.

Note that the Difficulty Target is a hexadecimal notation of the target hash whose mining difficulty is 1.

In contrast, the current target is the target hash of the most recent block of transactions. When the two values are divided, it yields a whole number which is the difficulty level of mining bitcoin.

For instance, if the answer is 24 trillion, then a miner is expected to generate approximately 24 trillion hashes before he can find the winning hash. Of course, sometimes miners can get lucky and find it with significantly fewer guesses.

Bitcoin mining difficulty is calculated with various formulas. However, the most common one is: Difficulty Level = Difficulty Target/Current Target.

Note that the Difficulty Target is a hexadecimal notation of the target hash whose mining difficulty is 1.

In contrast, the current target is the target hash of the most recent block of transactions. When the two values are divided, it yields a whole number which is the difficulty level of mining bitcoin.

For instance, if the answer is 24 trillion, then a miner is expected to generate approximately 24 trillion hashes before he can find the winning hash. Of course, sometimes miners can get lucky and find it with significantly fewer guesses.

How bitcoin mining difficulty is adjusted

Mining difficulty adjustments are made by comparing the standard time it should take to find 2,016 blocks of transactions on the Bitcoin network to the time it took to find the last 2,016 blocks. Keep in mind that the accepted block time is 10 minutes. Therefore, the expected time for mining 2016 blocks is 20,160 minutes (that is, 2016 X 10 minutes).

The network calculates the total time it takes to mine the last 2,016 blocks. The ratio of the standard 20,160 minutes (10 minutes x 2,016 blocks) to the time it took to scale the last difficulty epoch is then multiplied by the most recent difficulty level. The calculation yields a result that will determine the required percentage change in the mining difficulty that will bring the block time to the desired 10 minutes.

That said, an error in the original Bitcoin protocol makes difficulty level adjustments based on the previous 2,015 blocks instead of the theorized 2,016 blocks.

While a 10-minute block time is the goal, the mining difficulty cannot be altered above or below four times the current difficulty level. The upper limit for each difficulty epoch is a +300% change, while the lower is a -75% alteration. This rule is put in place to eliminate any abrupt changes in mining difficulty. https://binaryoptionrobot.trade/

Mining difficulty adjustments are made by comparing the standard time it should take to find 2,016 blocks of transactions on the Bitcoin network to the time it took to find the last 2,016 blocks. Keep in mind that the accepted block time is 10 minutes. Therefore, the expected time for mining 2016 blocks is 20,160 minutes (that is, 2016 X 10 minutes).

The network calculates the total time it takes to mine the last 2,016 blocks. The ratio of the standard 20,160 minutes (10 minutes x 2,016 blocks) to the time it took to scale the last difficulty epoch is then multiplied by the most recent difficulty level. The calculation yields a result that will determine the required percentage change in the mining difficulty that will bring the block time to the desired 10 minutes.

That said, an error in the original Bitcoin protocol makes difficulty level adjustments based on the previous 2,015 blocks instead of the theorized 2,016 blocks.

While a 10-minute block time is the goal, the mining difficulty cannot be altered above or below four times the current difficulty level. The upper limit for each difficulty epoch is a +300% change, while the lower is a -75% alteration. This rule is put in place to eliminate any abrupt changes in mining difficulty. https://binaryoptionrobot.trade/

Bitcoin Stuck in Narrow Range Unless There’s a ‘Vibe Shift,’ Analyst Says

Bitcoin Stuck in Narrow Range Unless There’s a ‘Vibe Shift,’ Analyst Says

- Expected rate hikes continue to point to rangebound crypto

- Breakout may need a tech rally or risk-on sentiment, Daye says

Bitcoin is unlikely to break above $46,000 anytime soon, barring a macroeconoic “vibe shift” like a change in risk-on sentiment, according to Wilfred Daye, head of Securitize Capital.

The cryptocurrency’s trading range narrowed this week as the war in Ukraine continued and the U.S. Federal Reserve raised rates in line with expectations. The notoriously volatile coin is on track to end the week 5% higher at $40,700, paring back its decline from a November high to 40%.

“Tactical longs in Bitcoin don’t have enough steam to get prices over that level,” Daye said, adding that price momentum was weak over the past five trading sessions. “For Bitcoin to breakout, a tech rally and macro risk-on sentiment are the key ingredients.”

Bitcoin prices have recently been mired in the tightest trading range since October 2020, which some attribute to long-term holders stepping in to buy when token prices decline as short-term investors curb the more substantial gains.

“Bitcoin is consolidating under $41,000 as the percentage of long-term holders in the market continues to increase,” said Marcus Sotirou, analyst at U.K.-based digital asset broker GlobalBlock. “But for 2022, I can’t expect an aggressive uptick in prices, because of the macro conditions.”

Bitcoin Miner TeraWulf Sets 2022 Hashrate Guidance

Bitcoin Miner TeraWulf Sets 2022 Hashrate Guidance

The company, which went public in December and counts among its backers actress Gwyneth Paltrow, also said its 2025 expectations remain on track.

TeraWulf (WULF), the environmentally minded bitcoin (BTC) miner that went public in December, sees itself reaching a hashrate range of 4.7 to 5.1 exahash per second (EH/s) by the end of 2022, according to a statement.

- The Easton, Md.-based company, backed by celebrities such as Gwyneth Paltrow, also expects to be able to successfully build out over 400 megawatts of mining facility in 2023, raising its hashrate to 12.1 to 17.2 EH/s.

- The miner reiterated its expectations of reaching 800 MW and 23 EH/s of mining capacity by 2025.

- The Bitcoin network’s total hashrate was 209.7 EH/s as of March 16, according to Glassnode data. By comparison, Marathon Digital (MARA), one of the largest bitcoin miners, said it sees reaching a hashrate of 23.3 EH/s by early 2023.

- For this year, TeraWulf is expecting a total of 210MW of power capacity, but notes the company could expand to raise power capacity to 235MW if the macroeconomic and capital markets improve.

- “Our focus in 2022 remains on continuing to build out our Lake Mariner facility in New York and Nautilus Cryptomine in Pennsylvania, ensuring we are well positioned to create as many plugs as possible to take advantage of significant Infrastructure and supply chain constraints facing the market,” CEO Paul Prager said in the statement.

- The company has raised a total of about $295 million to date and said it continues to take “an opportunistic approach” to raising capital.

- The shares of the miner have declined about 47% this year, while the price of bitcoin fell 15%. https://binaryoptionrobot.trade/

A Top Trader Made Over $700,000 On Binance Futures Last Month. Here’s How You Can Follow His Trades in Real-Time.

A Top Trader Made Over $700,000 On Binance Futures Last Month. Here’s How You Can Follow His Trades in Real-Time. In the course of the las...

-

Guyz Click Here to checkout the testimoney on my youtube about CRYPTOTAB HACK SCRIPT 2019 to 2033 - 14 BTC WORKING REVIEW Follow me o...

-

Guyz Click Here to checkout the testimoney on my youtube about CRYPTOTAB HACK SCRIPT 2019 to 2033 - 14 BTC WORKING REVIEW Pl...

-

A Top Trader Made Over $700,000 On Binance Futures Last Month. Here’s How You Can Follow His Trades in Real-Time. In the course of the las...